Germany, with its stable economy, strong legal framework, and vibrant real estate market, has emerged as an attractive destination for investors seeking long-term returns and asset diversification. In this comprehensive guide, we delve into the intricacies of the German real estate market from the perspective of an investor, exploring key factors such as market dynamics, investment strategies, regulatory framework, and potential challenges.

Germany, Europe’s largest economy and a key player in the global marketplace, boasts a diversified economy driven by manufacturing, exports, and a robust services sector. With a highly skilled workforce, technological innovation, and strong infrastructure, Germany offers a stable economic environment conducive to real estate investment.

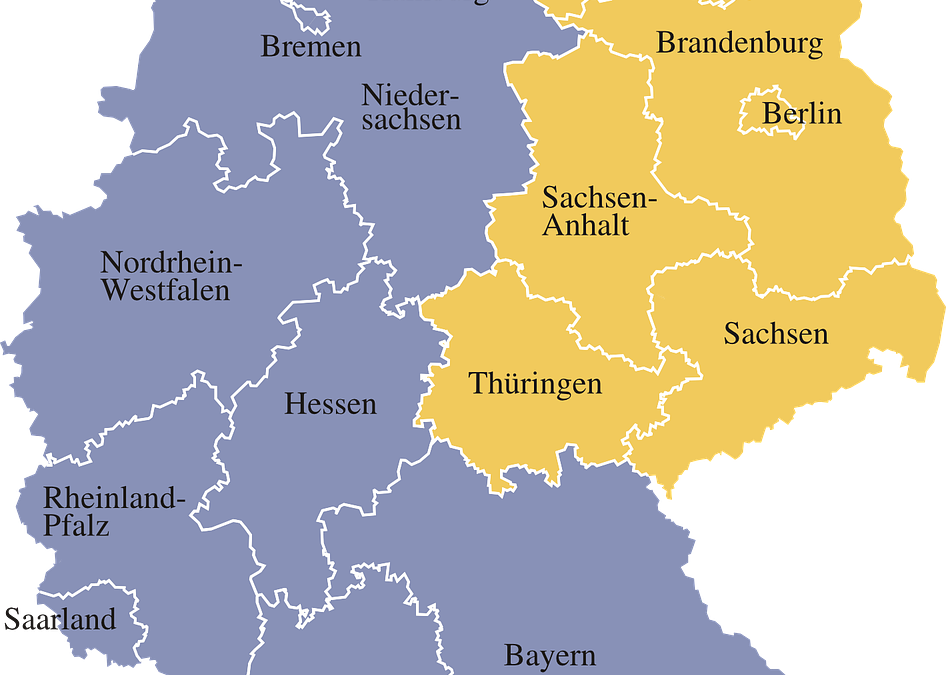

The German real estate market is characterized by regional diversity, with major cities such as Berlin, Munich, Frankfurt, and Hamburg attracting significant investor interest due to their economic vitality, cultural richness, and population growth. However, opportunities also exist in secondary cities and rural areas, offering investors a wide range of investment options to suit their preferences and risk profiles.

In recent years, the German real estate market has experienced steady growth fueled by low interest rates, urbanization, and increasing demand for residential and commercial properties. Residential real estate, in particular, has witnessed strong price appreciation in major cities, driven by factors such as population growth, limited housing supply, and strong rental demand.

Commercial real estate sectors, including office, retail, industrial, and logistics properties, have also performed well, supported by favorable economic conditions and growing investor appetite for income-producing assets. Additionally, the emergence of niche sectors such as student housing, healthcare facilities, and co-living spaces presents new opportunities for investors seeking diversification and higher yields.

Investment Strategies and Considerations

When considering investing in German real estate, investors must carefully evaluate their investment objectives, risk tolerance, and time horizon. Whether seeking capital appreciation, rental income, or a combination of both, investors can choose from various investment strategies, including direct property ownership, real estate funds, joint ventures, and development projects. Direct property ownership remains a popular choice for investors seeking greater control over their investments and the potential for higher returns. However, it requires thorough due diligence, market research, and active management to identify attractive investment opportunities, negotiate favorable terms, and maximize property performance.

For investors preferring a more passive approach, real estate funds offer diversification, professional management, and access to institutional-grade assets across different property sectors and regions. Real estate investment trusts (REITs) provide another avenue for investors to gain exposure to the German real estate market while enjoying liquidity, dividend income, and potential capital appreciation. While the German real estate market offers numerous opportunities for investors, navigating the regulatory framework and legal landscape requires careful consideration and expertise. Germany has strict regulations governing property ownership, leasing, taxation, and construction, which can vary depending on the location and property type.

Investors must familiarize themselves with German property law, zoning regulations, tenant protection laws, and tax implications to mitigate risks and ensure compliance. Additionally, cultural and language barriers may present challenges for international investors, highlighting the importance of working with experienced local advisors and legal professionals.

Investing in German real estate offers investors a compelling opportunity to capitalize on the country’s strong economy, dynamic real estate market, and stable political environment. By understanding the market dynamics, adopting suitable investment strategies, and navigating regulatory challenges, investors can unlock the potential for long-term growth, income, and portfolio diversification. With careful planning, due diligence, and expert guidance, investing in German real estate can be a rewarding and lucrative endeavor for investors seeking to build wealth and achieve their financial goals.